Sunday July 07, 2024

Volume 86

Hey besties!

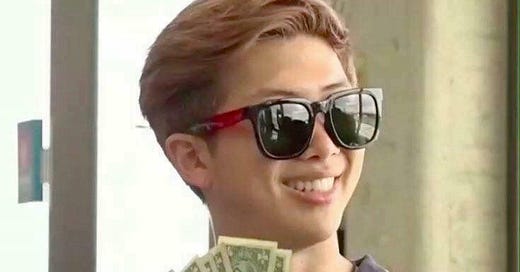

I had a bit of a big purchase this week; I bought myself a new purse! I typically try to keep my spending low when it comes to clothing purchases, but I’m in Italy right now post-wedding and couldn’t resist the VAT refund! Anyone who knows me knows I am a serious bag lady. A tiny purse looks cute for a night out, but I actually need to carry a ton of stuff, especially for traveling. I made a very pricey big girl purchase this week and got a new Dior Book Tote! I try not to spend on season-to-season designer, but try to really go for the pieces that are going to last me a long, long time. This was definitely a hefty purchase but something I had been thinking about and saving up for a while. With bigger purchases like this, I like to start saving in advance and put aside a little money here and there so that way, when the time comes to purchase, it’s a lot easier to let go of that cash. Saving up for and spending where your values lie is so important. It’s not about what’s trendy now but what will bring you happiness and stay with you for years to come. If you are looking for more information on budgeting, saving, and investing, check out my New York Times bestselling book Rich AF!

As a reminder:

HYCU, pronounced haiku: how the news impacts you and your wallet, aka How You Can Use

The Prosperitea: think discount codes, non-boring finance articles, sales, and personal links from the week. The fun stuff 😉

We love your comments, but please remember to keep it positive! And don’t take investing advice from anyone who isn’t your registered financial advisor!

Now that you’re up to speed, let’s get you enRICHed.

Chase Bank Firing Warning Shots 👀

Chase Bank is turning on the lights in its proverbial club, warning that it might start charging customers for previously free services like checking accounts and wealth management tools.

Basically, the Consumer Financial Protection Bureau is aiming to introduce regulations that would cap credit card late payment fees at $8 and a $3 cap on overdraft charges, as well as limit debit card fees and charges to software companies like Venmo and CashApp for accessing customer data.

In response, Chase CEO Marianne Lake said that this will lead to significant cost increases for everyday banking services, and Chase is planning on passing that cost to consumers. For reference, Chase is currently the largest retail bank and credit card issuer, with 86 million customers.

HYCU; Does it really mean anything? No, not yet—it’s more of a threat from Chase in the way your mom counted down from three as a kid, but this has happened before. Banks warned about imposing fees after the 2008 financial crisis but backed off after customers dragged them through the mud and back. That being said, Chase Bank customers should definitely keep an eye out on their checking accounts to see if they get any messages about incoming account charges. If you don’t want to get charged, you can also always call your bank and let them know that you are not happy about this warning! If they backed off once before due to public bullying, it could work again.

Amazon, Saks And Neiman Marcus Walk Into A Bar… 🛍

Saks Fifth Avenue and Neiman Marcus are officially merging to create a luxury department store empire, with a little investment injection from no other than Jeff Bezos’ multi-tentacled empire, Amazon.

This deal, which has been in the works for years, now gives the stores more leverage to negotiate with luxury brands for lower costs—Saks has 39 stores, while Neiman Marcus, which filed for bankruptcy in 2020, has 36 stores.

The luxury fashion industry has been going through some real growing pains in the last several years as department stores declined in popularity and the power of luxury brands caught a second wind through social media. CNN reported that this Saks–Neiman merger angles to wrestle back some of the department store control as brands like Louis Vuitton parent LVMH shift their distribution strategy to direct-to-consumer sales.

HYCU; Amazon’s imprint into this merger could mean major changes in the way fashion fanatics (read: me) access luxury fashion goods. The tech giant has the ability to streamline logistics and e-commerce, which could mean more luxury goods becoming available on the platform, as well as a potential shift in pricing. There’s still a long way to go, though—the merger is already sparking some concerns of monopolistic behavior from the FTC, meaning a lot of people are going to be wondering Deal or No Deal in the near future.

Gen Z Buying In Bulk 🥬🥕🍎

Young adults are battling sticker shock at the grocery store by buying in bulk from wholesale chains like Costco and Sam’s club, the Wall Street Journal reported this week.

As shrinkflation continues to keep its foot on our necks, people are trying to find creative ways to live below their means, and new data is showing that Gen Z shoppers are splitting the costs of groceries with friends, family and neighbors in order to manage their grocery expenses.

The two queens (Costco and Sam’s Club) have been fighting for Gen Z attention for a while now, investing in tech-forward services like the Sam’s Club scan-and-go app as well as AI-powered gateways that let customers roll out of the store without a person checking their receipt.

HYCU; No, this shouldn’t be our reality, but at least for the day-to-day, especially if you don’t have kids or a spouse, this is a really smart way to keep your costs as manageable as possible. Splitting your rent with roommates, your subscription fees with family, and your groceries with friends is a smart way to live within your budget and spend on the things you actually want to spend money on. Like, if soy milk is $4.99 at your local grocery store but $17.99 for a 12-pack at Costco, you may as well get your group chat to go in on the better value.

Commonly asked question: Vanessa asks, “Vivian-what do you think about IULs for children for college savings?”

Hi Vanessa, thanks so much for your question! IULs get a lot of publicity across social media because financial advisors and life insurance salespeople are very incentivized to sell them. These people make large commissions when you sign up for one. However, a major issue that I take with IULs is the fact that their initial setup costs and recurring premiums are incredibly high, meaning this type of insurance policy does not make sense for the vast majority of people. In my personal opinion, your dollars might go farther if invested in index funds in a 529 for your future kiddo’s education.

Want to be featured in our Question Bank section?

Rich Tip of the Week: Here’s how you can optimize your PTO this year!

Miki Sudo won her tenth hot dog eating championship this week at Coney Island and set a new world record for the women’s division, eating 51 hot dogs in 10 minutes — yeah, she literally ate.

Nick Cannon insured his *checks notes* private parts for $10 million. No, you’re not reading that wrong. $10 million.

Are you as obsessed with the new Netflix docuseries about the Dallas Cowboys Cheerleaders as I am? I fell into a really deep dive trying to figure out how much they get paid, and it’s wild.

SEE YOU IN THE COMMENTS BESTIES

Wow

Congratulations on the wedding and the bag! Also Saks-NM merger is 😳😳. Not a luxury-type girlie myself but even I know this is gonna be interesting! Love the VAT plug-in!