Sunday April 7, 2024

Volume 74

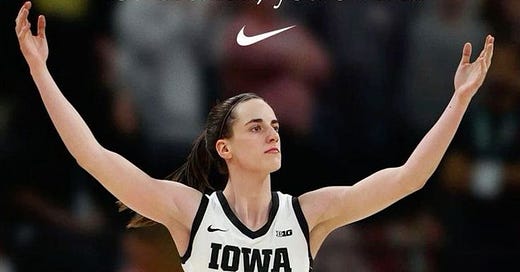

Championship Sunday 🏆🏀

After a weekend of college basketball, the Iowa and South Carolina women face off today for the 2024 NCAA Championship. It’s been a huge year for women’s college basketball, last week’s LSU vs. Iowa game set a ratings record with 12.3 MILLION viewers. It’s been all about Caitlin Clark this year, but there is talent all over the court, and that type of competition is so compelling. Appointment Television as they say!! Excited watch the culmination of a season of hard work and determination - these women deserve all of the recognition and more.

As a reminder:

HYCU, pronounced haiku: how the news impacts you and your wallet, aka How You Can Use

The Prosperitea: think discount codes, non-boring finance articles, sales, and personal links from the week. The fun stuff 😉

We love your comments, but please remember to keep it positive! And don’t take investing advice from anyone who isn’t your registered financial advisor!

Now that you’re up to speed, let’s get you enRICHed.

The Path of Totality is Paved in Gold ☀️🌑

So you’ve probably heard there is going to be a solar eclipse tomorrow. But have you heard about the tourism dollars surrounding it?

VOX reporter Li Zhou found that more than 4 million people in the US e are traveling to see the eclipse than for Taylor Swift’s Eras tour or the March Madness Championship games.

Even though a solar eclipse happens globally every 18 months, this particular one will be visible in many parts of the US - meaning it’s easier for people to find or put themselves in the path of totality.

The path will begin in Texas, travel upward through midwestern states such as Indiana and Ohio, ultimately reaching New York, New Hampshire and Maine.

Between money for gas, flights, lodging and food, economists predict that eclipse tourism could generate over $1 billion; Texas could see $1.5B in tourism alone. A unique example is Rangeley, Maine, home to 1,200 people. Rangeley expects 20,000 people for the eclipse, and is hosting events and activities such as “cosmic yoga, total eclipse paint night, and night sky trivia” to capitalize on the excitement.

HYCU; cities and towns across the US are bracing for tourism at levels they sometimes never see. To some, it may seem extravagant to travel for an event that lasts only a few minutes, but the US won’t have an eclipse as viewable as this one until 2044! And if you are traveling and wondering why your hotel room was so expensive? Well, now you know…

Friday Jobs Report 🏢💼

The Labor Department issued a new jobs report on Friday, and it was pretty strong!

The numbers showed that the US labor market is continuing to strengthen, with a growing labor force + moderate wage growth.

A look at the numbers:

Employers added 303K jobs in March, the strongest in 10 months.

The unemployment rate also came in at 3.8% - which is the 26th month in a row it has been below 4%

Average hourly earnings rose 0.3%

Labor force participation rate rose 0.2%

HYCU; what does it all mean for us? Brett House, economist and professional practice professor at the Columbia Business School, spoke to CNN on the implications for the Fed. He said that, for the Fed, the report was a “mixed bag: labor market strength continues to be greater than most forecasts…but hiring is increasing as wage growth is moderating.” Using CPI and PPI reports next week, there should be a better understanding of the Fed’s path to a decision regarding rate cuts.

BONUS: The Washington Post did a great article flushing out some more industry specific data, if you’re interested in learning more. Axios Macro also did a little explanation of “how to parse jobs data like a pro” which we love!

Making Ends Meet 🏡💸

A new Redfin report speaks to the 49.9% of renters and homeowners in the U.S. who are sometimes, regularly or greatly struggling to afford monthly housing payments.

The results focus on a question that many of the respondents were asked: “which of the following, if any, changes or sacrifices did you make in the past year to afford your monthly housing costs, including mortgage or rent, insurance, parking, heating/cooling/electric or homeownership associate dues?”

The most common sacrifice was that these Americans took fewer or no vacations (34.5%). 22% skipped meals, 20.7% worked extra hours, and 20.6% sold their belongings.

Even scarier are the 17.6% who dipped into their retirement savings and the 15.6% who delayed or skipped medical treatments. These are a different type of sacrifice than not taking a vacation (which is simply a smart financial decision if you can’t afford to go). These decisions directly impact your future earnings and health risks.

Why is this happening? Mortgage payments are still near their all-time high, with the median U.S. home sale price up 5% YoY and mortgage rates still around 7%.

There is racial disparity in these results as well. White and Asian/Pacific Islander respondents who struggle to afford housing were most likely to skip vacations, while Black respondents were more likely to work extra hours, and Hispanic respondents were most likely to sell their belongings.

HYCU; interested in buying a house but concerned about making payments? These reports not exactly making you feel confident either? Check out THIS VIDEO to get a crash course in mortgages including FHA loans, Conventional 97 loans, USDA loans and VA loans! Whether you are a first time home buyer, or just want to learn more, there are tons of resources to help make homeownership a reality for you.

Question from Elizabeth: Is debt consolidation a good idea? I'm considering doing it.

In some cases! Check out this video to learn more! We break down different debt paydown strategies - including debt consolidation!

Question from Lex: Can you talk about 457b plans and pros and cons?

A 457b plan is very similar to a 401k plan - aka an employer sponosred retirement plan. Pros - helps you invest for your retirement, get some tax benefits, and often your employer may also "match" or contribute to your account as well. Cons - your money is locked up until you're 59.5 and you can't access it except for a few special circumstances without penalty, the investment options in the account may be limited, and you'll need to roll it to an IRA once you leave your current employer.

TL;DR - for most people employer sponsored retirement plans are 100% worth doing and I highly recommend considering utilize this benefit your employer offers you!

Want to be featured in our new Question Bank section ?

Rich Tip of the Week: Spring Clean Your Finances

Study: Americans need a six-figure salary to afford a typical home in nearly half of U.S. states

New iOS update can make your smartphone less complicated and less distracting

Something I read this week: this interview from

with FONZIE, the women behind The Reformation email slogan and copy, was so interesting!Something I listened to this week: Hello, Molly! on audiobook was incredible. Molly Shannon brings the pages to life, and gives an inside look on her time at SNL and the birth of character Mary Katherine Gallagher.

Something I watched this week: Vintage SNL clips, of course! So many good ones.

SEPHORA SALE PICKS!

SEE YOU IN THE COMMENTS BESTIES

Thanks for the Link in Bio shout out!!

Are 4 million people traveling for the eclipse? Or 4 million more than the amount of people who traveled for Taylor swift? Or is 4 million just more than the amount of people that traveled for Taylor swift? Just looking for some clarification🤗